[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

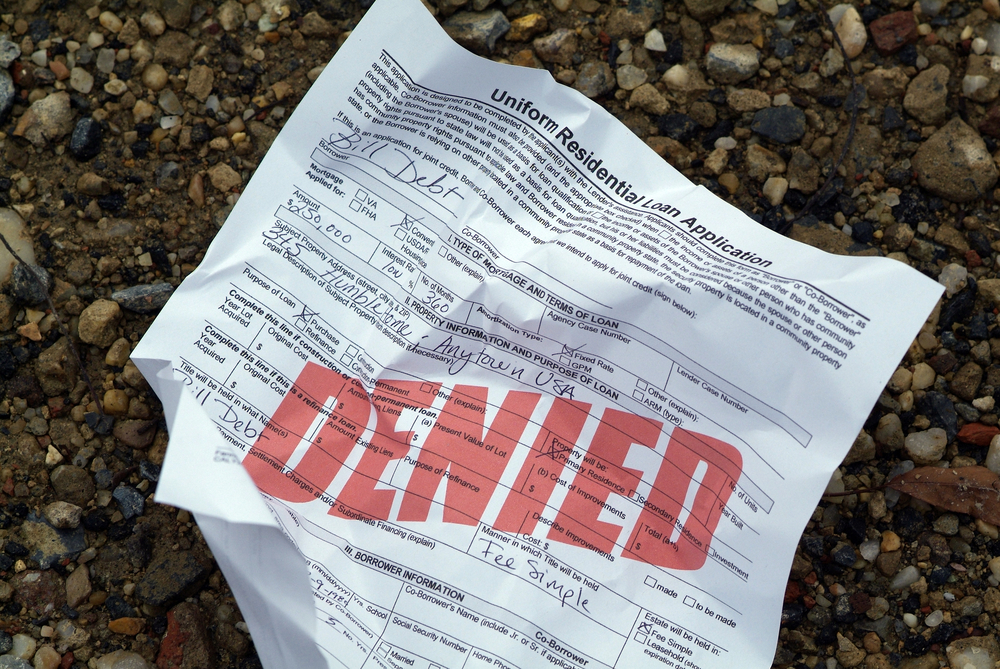

Getting a loan application denied is a frustrating experience. Instead of focusing on that frustration, however, it’s best to find out the reason for your rejection.

While every credit case is unique, here are some of the most common reasons why people are denied loans:

2023

Tax Forgiveness

We know how challenging it can be to pay off your tax debt.

The IRS just announced the 2023 Fresh Start Program, to qualify more people for tax relief!

Lack of income

It will be tough to get certain loans if you cannot prove you have the ability to pay them back. Home loans fall into this category, and the law requires such lenders to calculate your ability to pay before approval.

What happens if you’re denied due to a lack of income? You’ll need to find ways to increase your income, such as through side gigs or a second income, to get approval in the future.

Lack of credit

Having no credit history can knock you down a few notches in the eyes of creditors. They want to see a stable pattern of paying on time, but without any history, you won’t be able to show that.

If you’ve just started building your credit history, you may need a bit of time under your belt before you get approved for any significant loans.

Bad credit

Have you defaulted on any loans in the past? Do you miss payments regularly? Any issues that lead to bad credit can make it challenging to acquire new credit.

Too many inquiries

If you are in a rush to get credit, don’t make the mistake of applying for every card under the sun. Doing so could lead to denial, even if you’ve been approved for other cards.

When you apply for several credit cards or loans at once, creditors could see it as a red flag that you have financial issues. The more issues you have, the riskier a borrower you may be, and the less likely any loan will be repaid on schedule.

2023

Tax Forgiveness

We know how challenging it can be to pay off your tax debt.

The IRS just announced the 2023 Fresh Start Program, to qualify more people for tax relief!

High debt to income ratio

Do you have a ton of outstanding debt? If so, creditors may feel that you’ll have trouble paying any newly-acquired debt, which could result in rejection.

If it doesn’t look as if you’ll be able to pay new debt after looking at your income, a creditor will be wary of you as a customer. Remember, their main goal is to ensure you can make payments. Excessive debt makes that goal much harder to achieve.

Other reasons

Since each case is unique, there may be less common reasons that lead to getting your application denied. This can happen with mortgages, for instance, if an appraisal is too low and doesn’t match the desired loan that is much higher in value.

Although the reasons for rejection listed above apply to most cases, you should always ask your lender why you were rejected. They will usually tell you the reason, which can tell you what must be fixed now to get accepted in the future.[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]